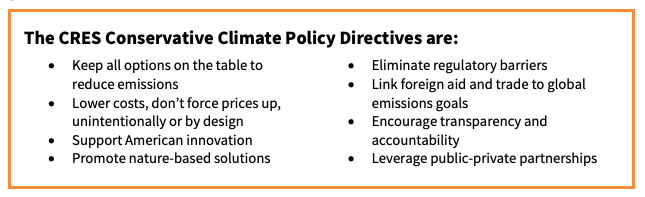

This briefing paper is part of CRES Forum’s Understanding the Facts Series, providing substantive background information on why and how conservatives should lead on climate change policy. The issues and approaches are rooted in CRES Forum’s Conservative Climate Policy Directives. These directives were developed to help policymakers and the public better understand how policies can reduce greenhouse gas emissions while promoting U.S. prosperity and fostering economic growth for generations to come.

U.S. Fossil Fuels Should Play a Crucial Role in Reducing Global Emissions

KEY FINDINGS

Displacing foreign fossil fuels with cleaner U.S.-produced fossil fuels would produce global environmental benefits and bolster U.S. economic and national security. Often overlooked as a tool to reduce greenhouse gas (GHG) emissions, intra-fuel switching — an option acknowledged by the IPCC— would encourage importers to shift from “dirtier” coal, natural gas, and oil to “cleaner” coal, natural gas, and oil, based on their life-cycle GHG footprints. In contrast to the traditional view of fossil fuel switching (e.g., coal to natural gas), intra-fuel switching does not typically require major changes to an economy’s energy system, allowing more immediate emissions reductions at a relatively low cost.

Western nations that produce fossil fuels would likely benefit from this policy framework and gain global market share, given the fact that their consumers already place a high value on environmental quality and many corporations are making immediate investments and voluntary commitments to further reduce GHG emissions. Conversely, state-owned enterprises would likely suffer as importing markets choose fuels that are cleaner. Such an approach would drive efficiency gains across the global fossil fuel supply chain, encouraging industry to invest in advanced technologies and adopt best practices—such as measures that reduce methane emissions.

Global demand for fossil fuels is increasing for the foreseeable future

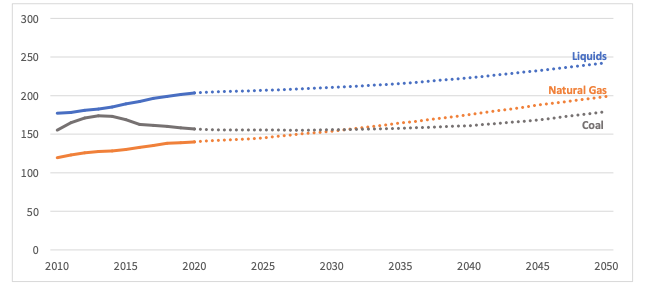

Figure 1: Projected global fossil fuel use (quad BTU)

Source of data: U.S. Energy Information Administration (EIA), “International Energy Outlook 2021,” 2021,

A well-informed climate strategy requires a firm understanding of how global energy demand impacts global greenhouse gas (GHG) emissions. Worldwide energy demand is expected to rise considerably through 2050, with overall energy use increasing by 47 percent from 2020 levels. Overall global fossil fuel use will rise 27 percent from today’s levels by 2050. Fossil fuels will represent a lower share of the total energy mix from today’s levels, which stand at 81 percent, but in 2050 they will still account for about 70 percent of total energy use: liquids (28 percent), natural gas (22 percent), and coal (20 percent). Rapid growth in renewable technology is expected at 165 percent, but it is limited to only 26 percent of total energy use.

Intra-fuel switching can reduce emissions

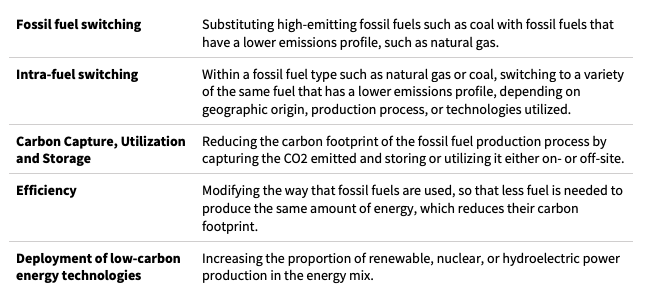

The IPCC suggests multiple opportunities to reduce energy sector GHG emissions. These include energy efficiency improvements and fugitive emission reductions in fuel extraction, energy conversion, transmission, and distribution systems; deployment of low-GHG energy supply technologies such as renewable energy, nuclear power, and CO2 capture and storage (CCS); and fossil fuel switching.

Table 1: Pathways to significantly reducing emissions from fossil fuels

While all the IPCC’s recommendations are worth consideration, one suggestion has received scant attention: intra-fuel switching (i.e., using cleaner sources of coal, liquids, or natural gas from a GHG perspective). To date, the policy debate on the benefits of fuel switching has almost entirely focused on replacing coal use with natural gas or renewables. Conventional coal-to-gas fuel switching, for example, has delivered substantial low-cost climate benefits and is estimated to be responsible for around 65 percent of U.S. emissions reductions between 2005 and 2019.

Unlike a conventional coal-to-gas shift, intra-fuel switching does not require an overhaul of a nation’s energy system. Consequently, the policy can offer GHG reductions more quickly and at a lower cost for economies that face obstacles in securing alternative fuel supplies or are unable to quickly construct requisite infrastructure (e.g., terminals, pipelines, and power plants). Further, because reductions can be achieved earlier, the cumulative benefits may be comparable to alternative policies that may not be fully implemented for several years.

Economically advanced nations, like the United States, typically have lower GHG life-cycle emissions associated with their economic activity, including fossil fuel production. Moreover, clean technologies and practices tend to be more widely adopted in market economies where the private sector has stronger incentives to be more efficient — in contrast to many state-owned operations. Intra-fuel switching should further incentivize industry to invest in technologies and practices that reduce life-cycle emissions in extraction, production, and transportation of fuels (e.g., addressing methane emissions).

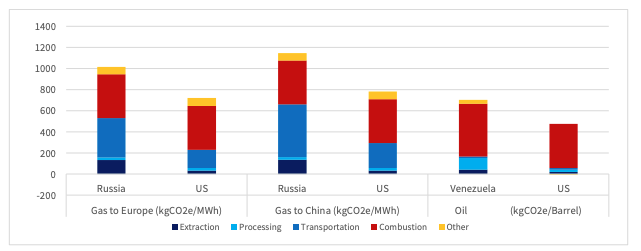

Importantly, the GHG life-cycle emissions of coal, natural gas, and oil vary by supplier — often significantly. For example, Russian-produced natural gas shipped by pipeline to Europe has approximately 41 percent higher life-cycle emissions (CO2 equivalent) than U.S. liquefied natural gas (LNG) shipped to the same destination (Figure 2). Russian-produced natural gas shipped by pipeline to China has 47 percent higher life-cycle emissions than U.S. LNG exported to China (Figure 2). In addition, heavy oil produced in Venezuela has 50 percent higher life-cycle emissions than light oil produced in Wyoming (Figure 2).

Figure 2: 20-year life-cycle emissions from fossil fuels, U.S. vs competitors,

Source of data: Deborah Gordon et al., “Know Your Oil: Creating a Global Oil-Climate Index,” Carnegie Endowment for

International Peace, (March 2015). http://oci.carnegieendowment.org/ and Selina Roman-White et al., “Life Cycle GHG

Perspective on Exporting LNG From the U.S. 2019 Update,” National Energy Technology Laboratory, (September 2019).

https://www.energy.gov/sites/prod/files/2019/09/f66/2019%20NETL%20LCA-GHG%20Report.pdf

The potential emissions reductions from intra-fuel switching are significant. For example, if the European Union (EU) replaced its Russian natural gas for electricity production with U.S. natural gas, the associated global emissions would fall approximately 72 million metric tonnes annually. For comparison, the EU estimates that it needs to reduce its emissions by 78 million metric tonnes each year to reach its 2030 targets. In the case of China’s projected imports of Russian gas via a recently completed pipeline, associated global emissions would be approximately 65 million metric tonnes higher annually than if China instead imported U.S. LNG.

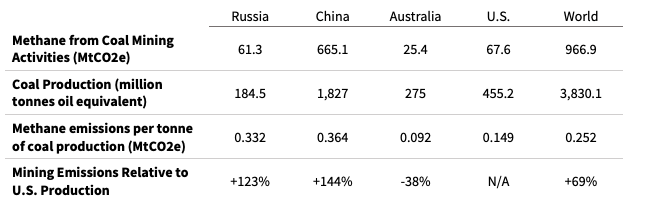

Comparable data related to thermal coal production is not as readily available, but evidence indicates that Chinese and other foreign coal is more emissions intensive than U.S. or Australian produced coal. Most coal mines in China are deep, and coal seams are highly impermeable, unlike those in the United States and Australia. A simple comparison of coal mining emissions relative to production in 2015 indicates that Chinese and Russian coal mines, respectively, emitted 144 percent and 123 percent more methane per ton of coal produced than U.S. mines. It should be noted that the global coal fleet increased by about 45 gigawatts (GW) in 2021, more than half of it driven by coal plant deployment in China.

Table 2: Comparison of methane emissions relative to coal production, 2015

Source of data: Global Methane Initiative (GMI), https://www.globalmethane.org/methane-emissions-data.aspx,

https://view.officeapps.live.com/op/view.aspx?src=https%3A%2F%2Fwww.globalmethane.org%2Fgmi-methane-data epa.xlsx&wdOrigin=BROWSELINK; and BP Statistical Review of World Energy, July 2021,

https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html

Encouraging a race-to-the-top in climate performance

Understanding the climate impacts of forgoing intra-fuel switching, or promoting it in the wrong direction, could help avoid uninformed policies that increase global emissions. For example, opposition to pipelines in New York has led to increased fuel imports from Nigeria and natural gas imports from Russia. As these energy sources have higher life-cycle emissions compared to U.S. energy supplies, anti-pipeline regulations in New York, which impede the flow of domestically produced natural gas, have resulted in higher GHG emissions.

Nonetheless, promoting intra-fuel switching as a climate mitigation tool is likely to face hurdles, though they are not insurmountable. Aside from reporting, monitoring, and verification requirements for determining life-cycle footprint, countries would be more likely to increase intra-fuel switching if they received emissions reduction credit for doing so. This change in policy would necessitate revising the way the international community tracks emissions. Current accounting is generally based on the production of GHG emissions within a country’s territory — and not consumption of GHG emissions embodied in imports, considering life-cycle emissions.

Example: Country X currently imports Country Y’s natural gas, which is more GHG intensive but cheaper than natural gas from Country Z. Because of existing accounting rules, Country X has fewer incentives to fuel switch to the less GHG intensive feedstock from Country Z. However, if accounting includes consumption of emissions, including those embodied in imports, Country X would have more inducement to intra-fuel switch to Country Z’s gas — action that would reduce Country X’s total emissions.

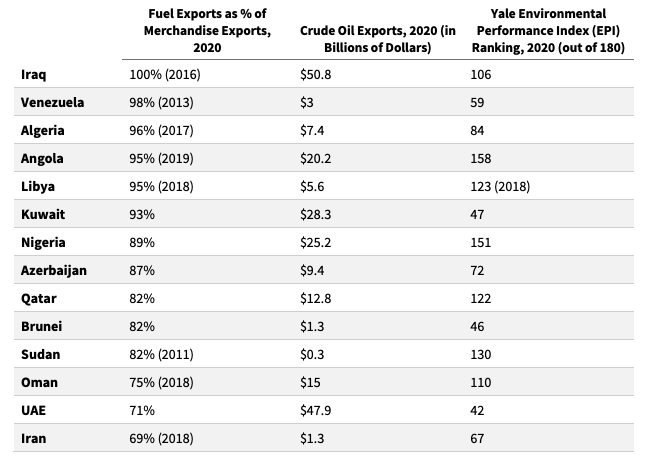

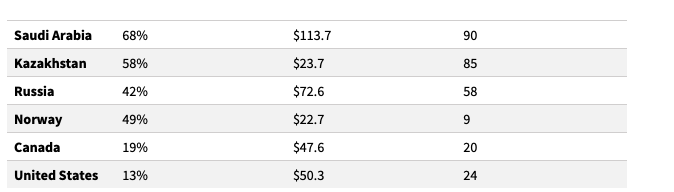

Incumbent producers with relatively high life-cycle GHG emissions for their fossil fuels would likely reject intra-fuel switching or changes in emissions accounting. On the international scene, opponents would likely include those that lack adequate environmental standards and are heavily dependent on fossil fuel exports for government revenue. Many major oil producers, for example, consistently rank poorly in environmental performance.

Table 3: Comparison of value of crude oil exports, fuel export dependency, and environmental performance

Source of data: (1) World Bank, “Fuel exports (% of merchandise exports),”

https://data.worldbank.org/indicator/TX.VAL.FUEL.ZS.UN, consulted 2 February 2022; (2) Daniel Workman, “Crude oil exports by

country,” https://www.worldstopexports.com/worlds-top-oil-exports-country/, consulted 2 February 2022; and (3) Yale 2020

Environmental Performance Index (EPI), https://epi.yale.edu/epi-results/2020/component/epi

Besides the emissions benefits of intra-fuel switching, the geopolitics of fossil energy would shift in favor of Western suppliers. While centrally planned economies would certainly continue to play a major role in supplying the global economy with fossil fuels, economies with strong democratic institutions and relatively stringent environmental standards would likely become more important exporters. Significantly, allies and partners of the United States would grow less dependent on fossil fuel suppliers that use energy as a political weapon or benefit from energy revenues that ultimately fund aggressive military behavior or terrorism.

Conclusion

Widely ignored, intra-fuel switching provides economies a lower-cost option to reducing GHG emissions more immediately; most efforts would simply entail switching to cleaner suppliers in contrast to the infrastructure investment needed for conventional fuel switching (e.g., coal to natural gas). While emissions reductions flowing from intra-fuel switching have limits, policies that promote it would encourage industry, including state-owned enterprises, to invest in transformative technologies like carbon capture and storage and methane capture on a voluntary basis. These policies would also accelerate the adoption of best practices, such as energy efficiency improvements and addressing methane emissions. Accordingly, intra-fuel switching could have a significant indirect impact on decarbonization of the fossil fuel sector.

Like any policy, of course, winners and losers would emerge. In general, private sector energy producers are cleaner from a GHG perspective — the most efficient of them would be well poised to gain global market share. Producers in the United States, Australia, and Norway would particularly benefit from a change in the emissions accounting of fossil fuel emissions — one that captures consumption of life- cycle emissions and credits importers for buying less GHG intensive energy supplies. Losers would include industry and state-owned enterprises that have failed to adopt higher environmental standards, most of which are headquartered in centrally planned economies.

Ironically, policies aimed at curtailing fossil fuel production in nations that produce fossil fuels with the lowest life-cycle emission rates, such as the United States, could result in increased global emissions, as rapidly developing nations increase their energy imports from suppliers that have higher GHG footprints. Sound climate policy should recognize that intra-fuel switching and further differentiation of fossil fuels in terms of environmental performance, as suggested by the IPCC, is an important tool in the overall effort to reduce global emissions. Given the reality of increasing global demand for fossil fuels, high-performing countries, like the United States, should advance policies that reduce global emissions by maximizing their lower-emitting exports. For their part, importing countries should implement policies that acknowledge the positive environmental impact of selecting cleaner producers when fossil fuels are purchased. And by doing so, it would open the door to a race to measurably reduce greenhouse gas emissions utilizing readily available technologies and methods.