Background

On January 26, the Biden Administration announced a de facto ban on pending decisions for exports of liquified natural gas (LNG) to non-Free Trade Agreement (FTA) countries, until the U.S. Department of Energy (DOE) updates the underlying analyses for authorizations.

The announcement sparked extensive global debate and for good reason. The lack of clear guidance on future steps and inconsistency in statements regarding the duration of the pause has caused instability among industry and policy leaders and concerns about potential supply shortages, price volatility and instability in both domestic and international markets emerged.

This decision and the risk of a more permanent ban implies to our allies that the United States may not be a reliable source for energy needed for their economic and national security in the longer term, causing some countries to turn to other adversarial suppliers for LNG–many of which have emissions-intensive production.

After following the law and approving Alaska’s Willow Project, the activist environmental base demanded concessions across the administration. The de facto ban on new LNG exports is one such excessive reaction, as the Biden Administration prioritizes election outcomes over the real-world implications for energy security, national security and global emissions.

Global Demand for U.S. LNG is Rising

Global energy demand is on the rise, with electricity needs projected to surge by 75 percent from 2021 to 2050. Currently, natural gas fuels about 40 percent of electricity generation in the United States. By 2040, natural gas is expected to generate around 30 percent of the world’s electricity, up from 20 percent in 2022. This increase in demand for natural gas includes LNG, which is anticipated to nearly triple, reaching approximately 660 million tons annually. As the world economy grows, the need for fuel sources with lower emissions will become increasingly imperative.

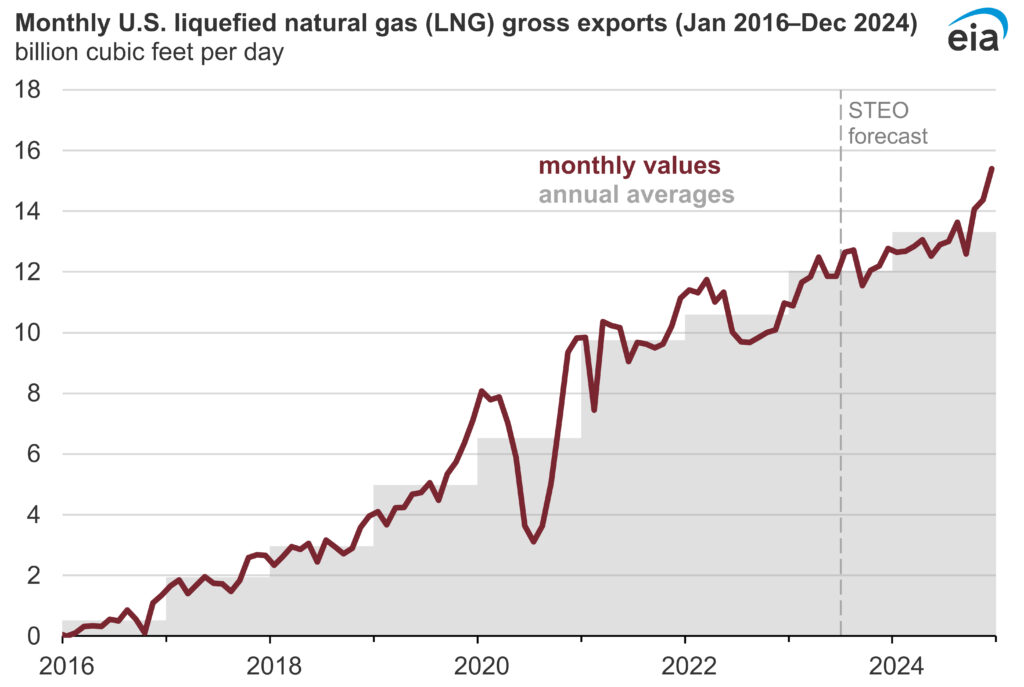

U.S. is the World’s Largest LNG Exporter

In 2016, the U.S. emerged as a net LNG exporter, owing to increased production, decreased imports and expanded export terminal capacity, driven by the shale revolution. Between 2017 and 2022, U.S. LNG exports surged by 450 percent, making the U.S. the world’s largest LNG exporter, surpassing Australia, Qatar and Russia. In October 2023, the U.S. reached a historic high of 12.4 billion cubic feet per day (Bcf/d), constituting nearly 10 percent of the total U.S. gas production. Anticipating further growth, pending no hindrance from the de facto ban, the U.S. Energy Information Administration (EIA) projects increased LNG exports in 2024.

A World Without U.S. LNG Exports: Assessing Impacts of the Ban

On a Clean Energy Future:

- LNG has a low emissions profile and reduces the number of harmful pollutants left behind that can impact air and water quality. Additionally, power sector emissions have declined 33 percent from the start of horizontal fracking from 2007 to 2021.

- U.S. LNG exports to China, Germany and India have displaced coal provided by other higher emitting exporters, reducing greenhouse gas emission by 50.5 percent, highlighting natural gas as a cleaner alternative.

- Moreover, Indonesia, Vietnam and South Korea have committed to gas-fired electricity as a reliable solution to stabilize variable renewable energy supply during downtime, enhancing grid stability.

- Compared to adversarial suppliers, research from the U.S. National Energy Technology Laboratory, revealed that Russian gas transported to Europe emits up to 22 percent more greenhouse gas (GHG) emissions, whereas U.S. LNG transported to Europe emits up to 56 percent fewer total emissions (as compared to European coal). Additionally, when compared to other competitive natural gas exporters like Russia, the United States boasts a 41 percent lower life-cycle carbon emissions profile.

On Domestic Implications:

- Proponents of the export “pause” often cite concerns about higher domestic prices for natural gas and electricity due to increased LNG production and export demand. However, American Petroleum Institutes’ (API) 2024 report demonstrates U.S. natural gas prices over the past decade remain among the world’s lowest, with Henry Hub prices 54 percent lower than the previous decade.

- API estimates that the industry’s operations, either directly or indirectly, added $1.6 trillion to the national economy in 2021, with an additional $156 billion in value added from capital investment. LNG exports have the potential to support between 220,000 and 452,000 additional American jobs and contribute up to $73 billion to the U.S. economy by 2040. Numerous natural gas producing states, such as Texas and Pennsylvania, may encounter lasting consequences stemming from the decision, jeopardizing thousands of good-paying American jobs.

- The Biden Administration has attempted to assure key stakeholders the temporary pause on pending applications will not affect already authorized exports and projects with prior approval which combined with existing plants. However, the announcement has sparked apprehension that an export ban will financially harm LNG projects and hamper the relations between the U.S. private sector and its trade partners across the world.

On National Security Interests:

- Following the War in Ukraine, by late 2023, Europe reduced its reliance on Russian natural gas imports to only 8 percent of total imports, down from the previous 41 percent. Simultaneously, U.S. LNG exports to Europe nearly doubled, establishing the United States as its primary supplier. In December 2023, Europe received 5.43 million metric tons (MT), representing just over 61 percent of total U.S. LNG exports. However, an LNG export ban will lead to a decline in the U.S. share of the global supply landscape, creating room for increased reliance on Russian natural gas, empowering Russia by providing additional resources to finance military efforts, especially within the context of the ongoing conflict with Ukraine.

- U.S. LNG exports not only enhance U.S. national clean energy security but also play a vital role in strengthening diplomatic ties. U.S. LNG shipping offers a strategic advantage of connecting to East Asian markets through the Pacific, all the while avoiding conflicts in the South-China Sea and promote political and economic security across the Asia-Pacific region.

Conclusion

The administration’s decision to “pause” LNG exports overlooks significant benefits of LNG exports such as stabilizing global energy markets, boosting American employment, supporting allies’ energy needs and contributing to global emission reduction.

Key takeaways:

- The uncertainty surrounding the duration of the pause and the Administration’s long-term LNG trade policy has stirred apprehension within the industry, potentially impeding investment and straining U.S. trade relations with allies.

- U.S. LNG provides a cleaner option with lower greenhouse gas emissions when transported to Europe, Asia and other developing countries, reducing global emissions. A pause in LNG supply without viable alternatives may cause supply shortages and price fluctuations globally, impeding the transition to cleaner energy sources. Additionally, restricted LNG supply from the U.S. could force these countries to turn to higher GHG emitting suppliers.

- A potential LNG export ban could undermine U.S. geopolitical influence, allowing Russia to increase its share of the global energy market and potentially financing military efforts.

- A pause in U.S. LNG production and exports would shift investment away from crucial infrastructure like LNG export terminals and the cultivation of trade partnerships. This acts contrary to U.S. energy policy goals of building resilience against supply disruptions and market fluctuations, undermining long-term energy supply chain security and national security goals.