Executive Summary

On March 21, 2022, consistent with President Biden’s climate agenda and in response to demands by certain investors, the Securities and Exchange Commission (SEC) proposed a climate-related disclosure rule (Rule). The Rule will drastically change how public traded companies not only disclose climate-related risks to investors, but also how companies comprehensively address the impacts of climate change on most aspects of their organizational structure, operations, and short- and long- term outlook. Following a public comment period ending on June 17, 2022, a final rule is expected by the end of the 2022.

Building off existing regulation that required climate-related disclosure through its business description, relevant legal proceedings, risk factors, and management’s discussion and analysis of financial discussions, as well as its implications on a company’s consolidated financial statement, the SEC created a new framework and applicable standards modeled on the Task Force on Climate-related Financial Disclosures (TCFD) and the Greenhouse Gas Protocol.

The proposed disclosure requirements focus on the governance, strategy, and risk management of the board of directors and management of companies. The focus is not merely on disclosing material information as was previously required, but rather expands the disclosure to include the identification, analysis, and management of climate-related decisions on a broad range of risks and potential opportunities. In addition, a company must disclose any targets or goals set and how those are to be met, including any identifiable progress.

A company will also be required to identify, categorize, analyze, and ultimately disclose GHG emissions both under its control and related to its energy consumption, as well as in certain cases, the emissions along its entire value chain. In addition, many companies will be required to have their disclosed emissions data attested to by an independent third-party in an annual report.

Lastly, the SEC proposes that climate-related disclosures be evaluated in conjunction with a company’s consolidated financial statements. Specifically, after a 1% threshold test, a company will have to analyze how the impacts of severe weather and transition activities will affect its bottom line, including an explanation, with estimates and assumptions used, about its expenditures and costs to potentially or in fact mitigate those risks and opportunities.

Key Findings from this white paper are:

- The SEC should defer to the Environmental Protection Agency (EPA) to improve the utility of existing data for investors instead of creating a new duplicitous GHG reporting disclosure framework that increases the reporting burden for companies.

- The SEC needs to adequately explain how the current regulations and legal protections for investors do not, or could not with updated guidance, provide reasonable investors with decision useful investment information.

- The SEC must provide a more robust and adequate cost-benefit analysis of the entire rule with particular focus on Scope 3 emissions given their incredibly high costs in both compliance and potential for increased liability.

- Lastly, to the extent that it must evaluate issues outside its jurisdiction and expertise, the SEC must explain how mandates on publicly traded companies will in fact accomplish their goal of addressing climate-related risk given the global issue of carbon leakage.

Introduction

Securities and Exchange Commission (“SEC” or “Commission”) is an independent regulatory agency created in response to the 1929 stock market crash with a tripartite mission: to protect investors; maintain fair, orderly, and efficient markets; and facilitate capital formation.

The Securities and Exchange Commission (“SEC” or “Commission”) is an independent regulatory agency created in response to the 1929 stock market crash with a tripartite mission: to protect investors; maintain fair, orderly, and efficient markets; and facilitate capital formation. In administering this mission, the SEC requires publicly traded companies to disclose financially material information to investors. Material information is based on “whether there is a substantial likelihood that a reasonable investor would consider it important in making investment decisions or that its omission would significantly alter the total mix of information used to make investment decisions.” Broadly speaking this disclosure process was originally a principles-based framework that developed a materiality standard to help guide the disclosure process. However, over time the SEC and various judicial interpretations have established a rules-based and at times prescriptive disclosure framework. In addition, following market failure Congressional action has required the SEC to mandate certain disclosures. This notably occurred after the Enron accounting scandal resulting in the passage of the Sarbanes Oxley Act of 2002. It happened again in response to the 2007-8 financial crisis resulting in the passage of the Dodd-Frank Act of 2010.

Material information is based on “whether there is a substantial likelihood that a reasonable investor would consider it important in making investment decisions or that its omission would significantly alter the total mix of information used to make investment decisions.

Some argue that failure to adequately account for climate-related risks in the financial sector and transition to a zero or low-carbon economy will have a devasting impact on the U.S. economy and ultimately result in a cataclysmic end to modern society. Others believe that climate-related risks are already accounted for in current risk assessments and that climate change is a global issue that will not be solved by enhanced corporate disclosure until state-owned enterprises, geopolitical factors, and technological advances are included to best address global climate change.

The financial impact of climate-related risks was prioritized by President Biden’s whole-of-government approach to addressing climate change in his January 27, 2021, Executive Order (“E.O.”). Specifically, President Biden called upon government agencies to evaluate the risks of climate change. Seemingly to answer that call, SEC then-Acting Chair Allison Herren Lee requested public input on updating the SEC’s climate-related disclosure of publicly traded companies. In a subsequent May 20, 2021 E.O., the President then asked agencies, including the financial regulatory agencies, “to advance a consistent, clear, intelligible, comparable, and accurate disclosure of climate-related financial risk.” He also instructed the Financial Stability Oversight Council (“FSOC”), and other agencies, to conduct an economy-wide evaluation of the risks of climate change. In October 2021, FSOC released its findings indicating that climate-related risk was an “emerging and increasing threat to U.S. financial stability.

On March 21, 2022, during a session of the SEC’s open meeting, the Commission voted 3 to 1 to propose “The Enhancement and Standardization of Climate-Related Disclosures for Investors” Rules (“Climate Rule” or “Rule” or “Proposal”) for public comment. The proposed Rule was published on April 11, 2022, with its comment period ending on June 17, 2022.

Since the release of the proposed rule, SEC Chair Gary Gensler has made numerous public statements in support of it. As a key rationale for the Rule, the Chair argued that it would provide investors with “consistent, comparable, and decision-useful information” for their investment decisions. He went on to say that the SEC has a role in standardizing those disclosures that are material to investors and importantly that the SEC has required disclosure of environmental issues since the 1970s. He also argued that many companies are already disclosing climate-related data under existing regulations, in their sustainability reports, and through the Task Force on Climate-related Financial Disclosures (“TCFD”) framework and the Greenhouse Gas (“GHG”) Protocol. Chair Gensler continued to explain referencing the proposed Rule’s substantive requirements such as disclosures related to corporate strategy, governance, risk management, targets, and GHG emissions, as well as its inclusion and connection to a company’s consolidated financial statements.

Some, such as Chair Gensler and Democrat appointed Commissioners, have argued that the proposed Rule is just an extension of existing disclosures requirements coupled with additional data that many companies are already disclosing. However, others, such as former SEC Chair Jay Clayton and Republican appointed Commissioners have argued that the proposed Rule is unnecessary, costly, and will be transformational to the SEC’s historic tripartite role regarding corporate disclosure. This white paper will first explore some of the background issues such as the actions that the SEC has already taken with regard to climate-related risk, then a review of the existing body of regulations regarding climate disclosure including the current sense of Congress, and finally an in depth look at what the proposed Rule will require from companies and key findings from the paper.

Background

Why Climate Is On SEC’s Agenda

Before the SEC issued the proposed Rule in March of 2022, it took a number of actions to address climate-related issues, seemingly in response to President Biden’s stated policy goals. Shortly after the President’s January E.O., then-Acting Chair Allison Herren Lee created a new Senior Policy Advisor for Climate and ESG in Office of the Chair. Then directed the SEC’s Divisions of Corporation Finance to enhance its focus on climate-related disclosure and assess corporate compliance under the SEC’s 2010 commission level guidance with the intent to amend it. This was followed by the SEC’s Division of Examinations announcing their 2021 priorities including a “greater focus on climate-related risk.” A day later, on March 4, 2021, the SEC announced a newly created 20-person Climate and ESG Task Force in the Division of Enforcement. The extraordinary actions taken by then-Acting Chair lead to a concerning response by the two Republican members of the Commission. Two weeks later, on March 15, 2021, the then-Acting Chair put out a request for public input on climate-related risk disclosure.

After the confirmation of Gary Gensler on March 2, 2021, where he indicated that he would “always be grounded in the courts, the law, and economic analysis about materiality….” (emphasis added), then-Commissioner Allison Herren Lee made a speech arguing that there were a number of misconceptions about “materiality,” which was widely thought of as the existing foundational analysis of what is to be disclosed under the SEC’s disclosure framework. While the request for public input on climate-related disclosure was an indication that the SEC was preparing for a rulemaking, the speech by Commissioner Lee may have been the first indication that the Commission was headed towards one that would be transformational in nature. This was further exemplified when it was later learned that the Commission was demanding companies to explain why their climate-related disclosures did included certain data they deemed material. When the companies responded that they did not find the data material, the writing was on the proverbial wall that a major change and likely controversial rulemaking was in the works. Interestingly, much of what was requested of the companies is now included in the proposed Rule.

Congress Is Politically Divided On The SEC’s Proposed Rule

While the SEC had a 3-1 democrat majority when the Rule was voted on in March of 2022, Congress had already acted when in June of 2021, it expressed its “sense of Congress” to the Administration and the Commission. By a 215-214 vote, the House of Representatives passed the Corporate Governance Improvement and Investor Protection Act of 2021 (“Disclosure Act”). The Disclosure Act was said to be a response to the growing interest in “what” information companies disclose and “how” they should disclose that information to the SEC. The Disclosure Act would have required the SEC to mandate the disclosure of climate-related risk information by finding that it was de facto material.

While no further legislative action was taken on the Disclosure Act, Senator Sherrod Brown (D-OH), Chair of the Senate Banking Committee, and numerous other Senate Democrats, have expressed their support for the SEC’s proposed Rule. However, Senator Joe Manchin (D-WV) sent a letter to Chair Gensler on April 4, 2022, expressing his concerns that the proposed Rule may run counter to the SEC’s tripartite mission by adding an undue burden on companies, that it is unnecessary because of existing regulations that capture material climate-related disclosures, and that it may signal opposition to an all-of-the-above energy policy that the majority of Senators support. The next day 19 Republican Senators sent a letter to Chair Gensler expressing their concerns that included those expressed by Senator Manchin, but also included references to the SEC’s lack of authority to impose “environmental regulations” and a concern with the SEC’s application of the materiality standard.

SEC’s Existing Role In Climate-Related Diclosure

Climate-related data has traditionally been considered non-financial data that is captured under Regulation S-K and further explained through the Commission’s 2010 interpretive guidance. Financial data, on the other hand, such as revenue, debt, expenses etc., is disclosed under Regulation S-X. The proposed Rule creates an entirely new section of Regulation S-K and takes a novel approach in its requirement that certain climate-related data also be disclosed under Regulation S-X.

Non-Financial Data Disclosure: Regulation S-K; 2010 Guidance; & Materiality Standard

Regulation S-K was originally implemented in 1977 to integrate disclosure under the SEC’s two authorizing statutes and has been expanded to capture certain non-financial data. Initially there were only two requirements: a description of the business and its properties, but more were added in 1978 and 1980. While the SEC expanded and reorganized S-K disclosures in 1982 as a collection of non-financial data, it has since been expanded multiple times through a fairly rigorous process. At that time, the focus was on mandating disclosure of environmental litigation and compliance costs as a result of enhanced Congressional action and subsequent regulatory activity. The pressure to disclose more and more data led to increased litigation ultimately resulting in the 1976 Supreme Court case of TSCIndustries. Justice Marshall writing for a unanimous Court established the materialitystandard or test to determine whether certain information must be disclosed. Justice Marshall thought of disclosure as a balancing act between giving investors enough information to make a reasoned decisions, but not so much information that they would be overloaded with an “avalanche” of information. The compromise the Court came up with was that informational is deemed material if “there is a substantial likelihood that a reasonable shareholder would consider it important” in making investments decisions, or stated another way, that the disclosure would have “significantly altered the ‘total mix’ of information disclosed.” The balancing of the materiality analysis has been the bedrock of disclosure for over four decades.

By 2010, the focus of disclosure was on climate-related issues. In response, the SEC published Commission level interpretive guidance (“Guidance” or “2010 Guidance”) on the existing disclosure requirements. The SEC acknowledged and supported the applicability of the materiality standard, but stressed that while ultimately disclosure was a management decision, doubts should be resolved in favor of disclosing information to investors as had been discussed in the TSC Industries case.

The 2010 Guidance focused almost exclusively on “clarifying” Regulation S-K Items 101 (Description of Business); 103 (Legal Proceedings); 105 (Risk Factors); and 303 (Management’s Discussion and Analysis). According to the Commission these S-K items were the most relevant of the non-financial disclosure regulations regarding climate-related issues. The Guidance specifically addresses how companies are to evaluate the impact of legislation and regulation; international accords; indirect consequences; and the physical impacts of climate change. It is noteworthy that these four Regulation S-K Items and four specific areas of focus are incorporated in the proposed Rule, though controversially, the materiality standard has been either altered or removed altogether similarly to what was called for by Congressional democrats in 2021.

ITEM 101: DESCRIPTION OF BUSINESS

Under item 101, a company is required to provide a description of the business, including each reportable business segment. It specifically includes “… principal products and services, major customers, and competitive conditions.” It is one of two of the oldest S-K requirements and is considered the foundation of disclosure under Regulation S-K. With regard to climate issues dealing with legislation and regulations, it specifies that disclosure includes material effects to compliance of environmental regulations that may have an effect on capital expenditures. The SEC indicated that it first addressed this this type of disclosure in the 1970s. In addition, there may be risks associated with the indirect consequences of climate change that have a such a significant impact on the business, including changing operational plans or its overall business purpose, that disclosure would be required under Item 101.

ITEM 103: LEGAL PROCEEDINGS

Under item 103, a company is required to provide a description of pending legal proceedings that are material as well as administrative or judicial proceedings relating to the environment if certain conditions are met. Ordinary business litigation is not required under a certain level, unless it is in violation of a law with the primary purpose of environment protection and meets other specific criteria i.e., material and damages or involves the government. It is worth noting that this limitation on disclosing ordinary business litigation was a revision “to address the problem that disclosure documents were being filed with descriptions of minor infractions that distracted from the other material disclosures included in the document.” Thus, the rationale was that companies were disclosing too much information to the detriment of investors.

ITEM 105: RISK FACTORS

Under item 105, a company is required to disclose climate-related risks under its broad requirement to discuss all “material factors that make an investment … speculative or risky.” These disclosures must be listed under each specific risk factor and with a deference to specific factors over generalities. This may require disclosure of specific risks associated with existing or even pending climate-related regulation or legislation and that those risks may be significantly different depending on the industry or sector. In addition, there may be disclosable risks associated with the indirect consequences of regulations or business trends as products and services are evaluated through the lens of climate change.

There are also reputational risks indirectly associated with climate change. This would likely depend on the company’s sector and the impact of public opinion. The idea that a company produces certain products or provides certain services that some find objectionable may result in certain investors refraining from investing. Reputational “risks” may be inherent in the nature of the business and considered not material for disclosure purposes. On the other hand, a company not known for certain products or services, or acquires additional business lines in those areas, may well find a material need to disclose that data. This is a good example of the dynamic aspect of materiality especially with the constantly changing opinions about how to address climate change.

ITEM 303 MANAGEMENT’S DISCUSSION AND ANALYSIS (MD&A)

Under item 303 (Management’s Discussion and Analysis (“MD&A”) of Financial Conditions and Results of Operations) a company it required to provide analysis and disclosure of “material events and uncertainties known to management that are reasonably likely to cause reported financial information not to be necessarily indicative of future operating results or of future financial condition.” The purpose of MD&A disclosure is to provide the management’s narrative perspective, context to analyze the financials disclosed, and the quality and variability of the disclosed data to help investors consider future performance in their investment decisions. The focus is on the future of the company and relies on both financial and non-financial information. While the Commission indicated that they have to continue to remind companies to be clear with their disclosures, “the flexible nature of this requirement has resulted in disclosures that keep pace with the evolving nature of business trends without the need to continuously amend the text of the rule.” The Commission acknowledged that some items under MD&A are rules-based and prescriptive and others are principles-based, but does not specify a “future time period that must be considered” though the future “trend, event, or uncertainly” must be “reasonably likely” to occur and satisfy a company’s materiality analysis.

The Commission also recognized that the “effectiveness of MD&A decreases with the accumulation of unnecessary detail or duplicative or uninformative disclosure that obscures material information.” This position was consistent with Justice Marshall’s warning in TSC Industries case about the dangers of too much information having a negative influence over investors. The Commission recognized that with advances in technology, management would be expected to review more financial and non- financial data, but would not necessarily result in more disclosure rather only that disclosure decisions would be better informed.

The Commission acknowledged the difficulty of preparing MD&A disclosure for trends, events, or uncertainties, and referenced their 1989 release that established a two-part test. The first part is whether it is “likely” to occur and absent that finding disclosure is not required. Second, if a determination cannot be made on the likelihood of its occurrence, management must assume it is likely and evaluate the impacts. Disclosure then is required unless management concludes that a material impact is not “reasonably likely” to occur. Companies are required to disclose the difficulties in analyzing this data and discuss when such difficulties may be overcome. This of course would depend on the event horizon of the data being disclosed. For example, some climate models are predicated on time judged in decades and not months or years.

Financial Data Disclosure: Regulation S-X

Regulation S-X requires a company’s consolidated financial statements and annual reports be filed with the SEC. These documents must be audited under the Generally Accepted Accounting Principles (“GAAP”). While the SEC relies on the Financial Accounting Standards Board (“FASB”) to create the standards, the SEC is ultimately responsible for enforcing those standards. As a result, the SEC works closely with FASB to ensure that the GAAP are capturing the necessary data. The data typically includes a company’s balance sheet, cash flow, operations, and outlook. The SEC has also advocated for “high-quality globally accepted standards” that may include consolidating the International Financial Reporting Standards (“IFRS”) through FASB’s continued work with the International Accounting Standards Board (“IASB”), who sets the standards under IFRS.

SEC mandates certain filings such as audited financial statements and MD&A as a foundational aspect of disclosure. However, unlike in filings under Regulation S-K, here a company’s primary focus is on its historical data with a forward-looking assessment based on that data. Ensuring that the data is accurate and consistent is of paramount importance.

SEC’s Proposed Climate Disclosure Rule

SEC’s Rationale for the Proposed Rule

The SEC provides numerous rationales for the proposed Rule. As previously discussed, the Biden Administration demanded that FSOC, including SEC as one of its members, evaluate the impact of climate-related risk on the economy. Based on FSOC’s recommendations, the Commission explained that climate-related risk and associated financial impact “could negatively impact the economy” and “create a systemic risk for the financial system.” Next, that the proposed Rule, citing their statutory authority, promulgated “in the public interest” and “would protect investors.” The Commission explains that requiring climate-related disclosure, presumably beyond what is already required, will “promote, efficiency, competition, and capital formation,” part of their tripartite mission, arguing that climate-related risks can have a impact on financial performance and may be material to investors.

Furthermore, the proposed Rule is based on investor demand for “consistent, comparable, and reliable” decision-useful information. Investor demand is repeatedly referenced throughout the proposed Rule citing “approximately 600 unique letters and over 5,800 form letters” in response to the March 15, 2021 request for public comment. The Commission explained that the comments expressed the position that the current regulations were inadequate to obtain the information they sought, and confirmed by a 2018 GAO report, and as a result had to look in places outside the disclosure framework. The Commission then concluded that if accurate, the current regulations are not adequately providing investors with the information they need nor in the format they want to make informed investment decisions. Lastly, as a result of investor and other stakeholder demands, companies are already providing much of the information sought resulting in investors using the information in their investment decisions. Therefore, requiring disclosure is necessary to provide investors with “consistent, comparable, and reliable” information. Further, according to Chair Gensler, companies must disclose in their official SEC filings because that is where investors look.

The Commission argues that the “primary benefit” is that it will provide investors with more “consistent, comparable, and reliable” information. The costs would be mainly in compliance where companies “may need to re-allocate in-house personnel, hire additional staff, and/or secure third-party consultancy services.” The economic analysis of the proposed Rule estimates the cost at almost $10.3 billion.

Disclosure Framework & Standards: TCFD & GHG Protocol

As a result, they evaluated a number of frameworks and standards and decided to model the proposed Rule on the Task Force on Climate-Related Financial Disclosures (“TCFD”) framework and the standards from the GHG Protocol. In selecting TCFD and the GHG Protocol, the SEC argued that many companies were already using both for disclosing relevant climate-related data. However, their voluntary use based on a company’s materiality analysis did not produce the type of consistent, comparable, or reliable data that the SEC contemplated in the proposed Rule. As a result, the SEC is proposing that disclosure and analysis be mandatory, with limited exception, including all four foundational categories of the TCFD framework and calculation of a company’s emissions using the GHG Protocol.

Once the SEC decided on the framework and standards to use, it drafted section 1500 which would be an entirely new section under Regulation S-K.

The SEC had to grapple with whether they should modify existing regulation and guidance under the existing framework or create a new framework to disclose and standards to evaluate the data. The SEC decided that neither the existing framework and accompanying guidance, nor current standards were sufficient to produce “consistent, comparable, and reliable” disclosures.

Governance & Management of Climate-related Risks & Strategy

Under §1501 (Governance), a company must disclose the board of director’s (“Board”) specific oversight obligations and the management’s specific role and process for assessing climate-related risks and, if applicable, related opportunities. This includes how the Board collectively analyzes data, staffs the issues, ensures expertise, creates goals and targets, and evaluates progress. While most companies assess these issues as they become relevant, the rule requires an explanation of their oversight and analysis.

Under §1502 (Strategy), a company must describe climate risks and opportunities that are “reasonably likely to have a material impact” on the company which may occur over a defined “short, medium, and long term” time horizon. These risks must be described as physical or transitional risks. Physical risks include acute risks, which are typically short term and event driven such as a hurricane. Physical risks also include chronic risks, which are over a longer term such as rising sea levels and extreme fluctuations in temperature. Transition risks include the “actual or potential negative impacts” on a company that occur as a result of but not limited to regulatory, legislative, policy, liability, reputational or market changes in response to climate-related issues. The company must also provide a narrative discussion of whether and how the “risks,” including a discussion of climate-related “metrics,” affected or are reasonably likely to affect the consolidated financial statements filed or that will be filed with the SEC. This last point is a reference to the confluence of Regulation S-K and S-X as previously discussed.

In addition to disclosing a discussion of climate-related risks, a company must also describe the actual and potential impacts of those risks including the time horizon for each impact on their business operations including their value chain, mitigation efforts, and expenditures. The discussion should consider whether the “impacts” are part of the company’s “business strategy, financial planning, and capital allocation” analysis. This disclosure should also include both “current and forward looking statements” in describing whether the identified “risks” have been integrated into the business strategy including how resources are being used to mitigate those risks. There is also a requirement to discuss how the metrics discussed in other sections of the proposed rule relate to the company’s business strategy including the use of carbon offsets or RECs, renewable energy credits or certificates, if applicable.

A business must also disclose a description and analysis of any “internal carbon price” used, including the rationale for its use. In describing the business strategy under this section, a company must also address its “resiliency” and discuss any analytical tools such as a scenario analysis. If a scenario analysis is used, a qualitative and quantitative analysis and description of each scenario is required including the parameters and assumptions used.

Under §1503 (Risk Management) a company must describe the “processes” used for “identifying, assessing, and managing climate-related risks” or applicable “opportunities.” If applicable, the description must include how companies compare these climate-related risks to other risks, consider current or likely regulations, evaluate consumer shifts, technological advancements, and market price volatility with regard to transition risks. The SEC also wants to know the process by which a company makes a materiality determination.

The company must describe, as applicable, the process for deciding whether to “mitigate, accept, or adapt to the identified risks.” In addition, whether a company prioritizes climate-related risks, and the process by which it may mitigate any “high priority” risks. A company must also disclose if any of its climate-related risk “processes” are integrated in the broader management system including whether and how internal committees addressing the issue, interact with the board and management.

If a company has a “transition plan” as part of its risk management strategy, it must disclose the “relevant metrics and targets used to identify and manage any physical and transition risks.” The SEC is also requiring a company to update their transition plan annually with actions taken to progress toward its targets or goals. In addition, if applicable, a company must explain how it “plans to mitigate or adapt to any identified physical … or transition risks.” The SEC specifies that transitions risks include legislative, regulatory, or policies that restrict “GHG emissions or products”; “protect land or natural assets”; “impose a carbon price”; or if changes in stakeholders’ preferences.

A company with an adopted transition plan, may also describe how it intends to take advantage of transition opportunities such as the development of new products and services, increased use of renewable energy, enhanced use of recycled materials, or conservation goals.

Climate-related Targets & Goals

Under the proposed rule §1506 (Target and Goals), a company must disclose its climate-related targets or goals (targets) if it has set them. These targets may include goals set in response to existing or likely regulations, market volatility, or other climate-related policies disclosed under §§1502 and 1503. The SEC is also requiring that a company disclose the targets’ scope, measurements, time horizons, baselines, interim settings, and importantly how the company plans to achieve them. There is also a requirement to disclose annually whether there was progress and if so, how it was achieved. Further, if carbon offsets of RECs are used in the target plan, the SEC requires the disclosure of the amount of carbon reduction, source, description, location, certification, and costs of the carbon offsets or RECs.

Under the proposed rule a company must disclose its climate-related targets or goals (targets) if it has set them.

GHG Emissions Metrics: Scopes; Intensity; Methodology & Liability

Under the proposed rule §1504 (GHG emissions metrics), a company must disclose their GHG emissions for the most recently completed fiscal year and for past years that are included in its consolidated financial statements if that historical data is “reasonably available.” The emissions must be disclosed in both the disaggregate form according to the type of GHG emissions and in terms of its carbon dioxide equivalent (CO2e) as well as in the aggregate, excluding the impact offsets. CO2e is the measurement used to calculate each of the GHG’s global warming potential (GWP). It is important to note that each GHG has a different ability to absorb energy (radiative efficiency) and length of time it stays in the atmosphere (lifetime), both of which are part of their calculated GWP.

Under the proposed rule a company must disclose their GHG emissions for the most recently completed fiscal year and for past years that are included in its consolidated financial statements.

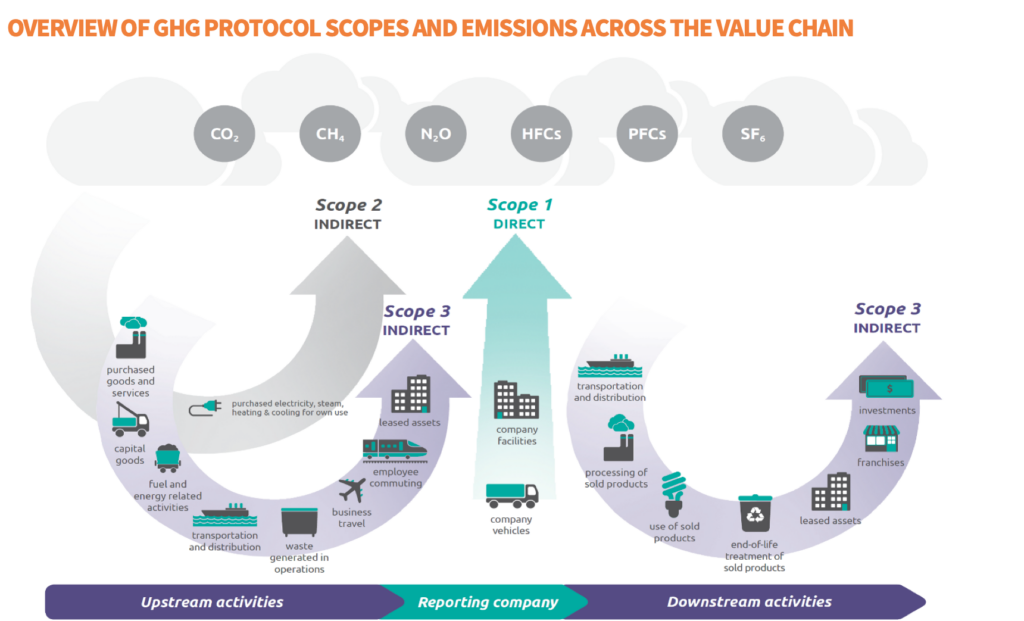

Source: WRI/WBCSD Corporate Value Chain (Scope 3) Accounting and Reporting Standard.

SCOPE 1 & 2 EMISSIONS

In addition to disclosing in both the disaggregate and aggregate, a company must disclose emissions according to their Scope. There are three Scopes through which a company must disclose, though not every company has to disclose under all three scopes. The first is Scope 1, which includes all GHG direct emissions from operations owned or controlled by the company. The second is Scope 2, which includes indirect GHG emissions from the generation of energy purchased and consumed by the company. The third is Scope 3, which includes indirect or value chain GHG emissions that are not included in scopes 1 and 2, which are calculated from upstream (e.g., purchased goods, raw materials, employees commuting) and downstream (e.g., life cycle of sold products, third party usage, investments) activities.

All three of the Scopes must be disclosed separately and Scopes 1 & 2 must be calculated using a company’s “organizational” and “operational” boundaries but may exclude investments not included in their consolidated financial statement.

SCOPE 3 EMISSIONS

Material Scope 3 emissions must be disclosed, unless the business is a “smaller reporting company.” In addition, a company that has seta GHG reduction target will also be required to disclose Scope 3 emissions even if they would otherwise be exempt. Disclosures must include both upstream and downstream emissions categorized by activity. Any category that is significant to a company must have its emissions data separately disclosed.

Material Scope 3 emissions must be disclosed, unless the business is a “smaller reporting company.” In addition, a company that has set a GHG reduction target will also be required to disclose Scope 3 emissions even if they would otherwise be exempt.

A company must also describe the source of their emissions data reported through parties in their value chain and whether the company or a third party verified the data. In addition a company must disclose other data sources including economic studies, databases, government statistics, industry associations or other third-party source outside their value chain. One thing to keep in mind is that Scope 1 and 2 emissions of one company are likely the Scope 3 emissions for another company if in their value chain, which in an ideal world, would lessen the burden of collecting Scope 3 data. Unfortunately, unless an exception is made, a company would still be responsible for Scope 3 data.

GHG INTENSITY

Once Scope 1 & 2 emissions are added together (Scope 3 is disclosed separately), a company must disclose the GHG intensity. GHG intensity is to be disclosed “in terms of metric tons of CO2e per unit of total revenue and per unit of production relevant to the company’s industry.” If there is no revenue or unit of production, a company must explain and disclose another financial measure of its GHG intensity. A company may choose to disclose additional nonfinancial or other measures of GHG intensity provided it explains why it is doing so and it’s useful to investors.

METHODOLOGY

A company must also disclose the methodology used, including any significant inputs and assumptions and a description of the organizational and operational boundaries (including an explanation of its Scope 1 & 2 determination), and the calculation approach (including emission factors) and the tools used to calculate the GHG emissions. As a potential guide, the SEC references the EPA’s set of “emission factors” and the GHG Protocol’s “calculation tools” and indicates that a company must disclose the factors to be used and identify its source.

A company’s organizational and operational boundaries must be consistently applied throughout their organization, consolidated financial statements, and in calculating Scope emissions. A company may use “reasonable estimates” of emissions, provided it gives a rationale and describes the assumptions used. When evaluating a company’s fiscal year for calculation purposes, a company may use its first three quarters to provide an estimate for its fourth quarter, provided it subsequently files any material difference between the estimated and actual emissions data. In addition to the estimates, a company may provide a range of emissions data, with an explanation including assumptions.

A company must provide any use of third-party data, identifying the source and assurance process taken, if material to calculating its GHG emission regardless of scope. A company must annually disclose any material change in methodology or assumptions. It must also disclose how it addressed any gaps in data and its impact on the accuracy of its emissions disclosure.

Under a Scope 3 materiality analysis, a company must include emissions from “outsourced” activities that would have previously been captured under Scope 1. In addition, it must describe and explain any significant overlap of Scope 3 data and its impact.

LIABILITY FOR SCOPE 3 EMISSIONS

The SEC indicated that, with regard to Scope 3 emissions disclosures in this section, a statement made would not be considered “fraudulent” unless it was made without a reasonable basis (negligence) or not made in good faith.

Attestation Of Scope 1 & 2 Emissions

Under §229.1505 (Attestation) the SEC requires that “accelerated” and “large accelerated” filers must provide an attestation report certifying their emissions data. For the first fiscal year, filers can rely on “voluntary” assurances of the data provided they comply with §1504(e), which requires additional disclosures if the data submitted was subject to third-party attestation or verification. In the second and third fiscal years, accelerated and large accelerated filers must at a minimum have a “limited” assurance of the accuracy of the emissions data. In the fourth and all subsequent fiscal years, accelerated and large accelerated filers must have a “reasonable” level of assurance and at a minimum cover Scope 1 & 2 emissions disclosures. Non-accelerated and large accelerated filers would have to comply with §1504(e) to the extent that its Scope 1 & 2 emissions data was subject to third-party attestation or verification.

ATTESTATION PROVIDER

The attestation report must be prepared and signed by a “provider.” The SEC defines a “provider” as one that 1) has significant experience in “measuring, analyzing, reporting, or attesting to GHG emissions.”; and 2) is independent from the company. Independence is judged on the ability of the provider to exercise “objective and impartial judgment” on all issues in their engagement with the company. The engagement between the company and the provider includes the period covered in the report and either when a contract is signed or work began, whichever was earlier. In determining independence, the SEC includes both a “reasonable investor” standard and factors the SEC would consider. Specifically, the SEC would consider any relationship or potential conflicts of interest with the company or its affiliates and “all relevant circumstances” during the engagement period.

ATTESTATION REPORT REQUIREMENTS

The report must be filed under a separate section captioned as “Climate-Related Disclosures.” The form and content must follow standards used by the provider. However, at a minimum the report must include a description of the subject matter; work performed; and criteria measured against. In addition, there must be a statement regarding: the level of assurance; standards used; the company’s and provider’s responsibility during engagement; independence; and any significant limitations.

Lastly, it must include a provider’s conclusion with a signature, date, and location issued.

The SEC also requires companies to disclose and give background on, within the captioned “Climate- Related Disclosure” section, whether a provider was licensed, subject to oversight, and had any record-keeping requirements during the engagement period.

VOLUNTARY ATTESTATION DISCLOSURE

The SEC has an extensive list of disclosures under voluntary attestation including disclosing the provider’s identity, standards used, level and scope, results, conflicts, and any subjected oversight. For non-accelerated filers these must be provided in a separate section captioned as “Climate-Related Disclosure.”

The SEC also added two new relevant sections under Article 14 of Regulation S-X addressing climate- related instructions and metrics. As previously mentioned, Regulation S-X provides the framework for reporting financial data in a company’s consolidated financial statement.

Climate-related Data through Consolidated Financial Statements (Reg. S-X)

Under §210.14.01 (Climate-related disclosure Instructions), a company must include any disclosure pursuant newly proposed §229.1500’s (Regulation S-K) requirements and use its listed definitions. When calculating metrics in this section, a company must use data that is consistent with the data used for its consolidated financial statement and apply the same accounting principles if applicable. A company must also disclose the data for its most recently competed fiscal year and must consider and disclose any climate-related data as it would for other historical data that are required.

Under §210.14.01 (Climate-related Metrics), a company must provide contextual information about each metric including a description of inputs, assumptions, and internal policy decisions relied on for disclosure. The rule establishes a 1% minimum threshold in determining whether climate-related impacts and separately the aggregate amount of expenditures expensed and capitalized costs incurred must be disclosed. The impacts, expenditures, and capitalized costs referenced apply to those from severe weather, transitions activities, climate-related risk, and opportunities.

If the 1% threshold is met a company must disclose separately any positive and negative financial impacts from severe weather and transition activities. A company will also have to disclose in the aggregate any expenditures and capitalized costs to mitigate risks of severe weather and in response to any transition activities to reduce GHG emissions or mitigate any transition risk. If a company has previously disclosed a GHG reduction target or goal it must disclose any expenditures or costs in meeting those targets in the years identified. In addition, a company must disclose if and qualitatively how financial estimates and assumptions used in producing its consolidated financial statements were impacted by the risk and occurrence of severe weather events or transition activities. Further, a company must disclose the impact of any identified climate-related risk both as physical and transition risks. A company may include the impact of any climate-related opportunities associated with the risks of severe weather and transitions activities but must do so consistently in the fiscal years presented if more than one.

Key Findings and Conclusion

Key Findings

To address the concerns over an SEC Rule’s ultimate effectiveness, consensus driven Congressional action is the better approach to truly solve the climate problem. Unfortunately, the SEC is pressing ahead without bipartisan Congressional support positing a mandate for unprecedented, detailed climate-related risk data that goes well beyond the existing requirement for companies to report on material risks. Based on this analysis policymakers should consider the following concerns and recommendations:

The SEC should defer to the EPA to improve the utility of existing data for investors instead of creating a new duplicitous GHG reporting disclosure framework that increases the reporting burden for companies.

One concern is that the SEC has used their statutory mission to “protect” the public and investors as an excuse to not only require unnecessarily detailed information for investors but require the type of information that the public already has access to. Specifically, under the EPA’s Greenhouse Gas (GHG) Reporting Program, 85-90% of U.S. GHG emissions are captured with detailed disclosure from the largest emitters. The 10% not covered under the reporting program, given its exponential costs, is more generally catalogued through the U.S. Inventory of GHG emissions. Combined, both the public and investors have more than enough macro-level information from both a societal and investment perspective. To the extent disclosed emissions data is material, the SEC should allow reference to the data provided to EPA. And to the extent investors seek up-stream Scope 3 emissions data for businesses, the SEC and EPA should encourage voluntary disclosure and embark on a period of learning to better delineate appropriate reporting boundaries to avoid double counting or gaps in accounting.

The SEC should better develop their cost-benefit analysis in the final rule.

The SEC indicates repeatedly that another rationale for the rule is based on “investor demand.” However, the SEC does not appear to differentiate between the different types of investors that may or may not be demanding the enhanced disclosure. This in spite of the fact that the same 2018 GAO report that the Commission cites to support investors demand for a disclosure, clearly indicates that the SEC’s own Investment Advisory Committee told GAO investigators that “investors have not agreed on the priority of climate-related disclosures.” Differentiating the various interests of these investors would address the appearance that they are favoring one type of investor over another and that those investors may well have different goals and investment strategies. There is scant evidence that the SEC has adequately contemplated the interests of retail investors in relations to large institutional investors.

Furthermore, the analysis must better explain the overall costs and benefits with considerably more specificity. As proposed, the SEC acknowledges that they are “unable to reliably quantify … potential benefits and costs” finding that the rule may ultimately cost over $10 billion. This is even more concerning by the admission that “existing empirical evidence does not allow [the SEC] to reliably estimate how enhancements in climate-related disclosure affect information processed by investors…” Given that additional climate-related data is the foundational aspect of this proposed Rule, the SEC may want to consider a more incremental approach that would be far less costly until it can provide an adequate cost-benefit analysis.

This could easily be done through updating their 2010 interpretative guidance that specifically addressed how companies must evaluate climate-related risk. Updating this guidance document would also confirm that while disclosure is to protect investors, the courts have placed the burden of disclosure on the boards and management of companies. Companies are required to apply a materiality standard to ensure that reasonable investors get the information they need to make sound investment decisions while balancing against an “avalanche of information” that would likely confuse a large segment of investors. It appears from the record that in early 2021 the SEC did intend on updating the 2010 guidance. An incremental approach focused on updating guidance should be seriously considered as an alternative to the proposed Rule.

The SEC should more fully evaluate how mandates on publicly traded companies may lead to carbon leakage—climate change is a global issue.

The SEC references other international disclosure frameworks but does not adequately explain how their proposed Rule would address companies choosing to go private or sell off their carbon intensive assets and its impact on retail investors, leading to less investment opportunities and carbon leakage. In mandating not only a prescriptive disclosure framework but also attempting to change corporate behavior, the SEC fails to consider the influence of state-owned enterprises and countries such as China that have double the emissions of the U.S. It is well understood that American producers are among the most carbon efficient in the world. The chilling effect of this Rule on American production could lead to increased competitiveness of less carbon efficient offshore production. It would be tragically ironic for an SEC rule focused on reducing climate-related risks to actually be responsible for an increase in those risks.

Part of any regulatory analysis must include an explanation of how the proposed regulations will achieve its goals. Here, without acknowledging the largest GHG emitters in the world or the issue of carbon leakage, the SEC has significantly missed the mark of “protecting” the public. As for the investor, without a more robust explanation of global factors, how could the SEC expect that a reasonable investor would benefit from the proposed enhanced disclosure if that rationale for those disclosures are based on an inadequate analysis on its financial impact toward addressing global climate change.

The SEC should acknowledge that requiring Scope 3 emission disclosure adds unnecessarily to the cost of the rule in both compliance and increased liability.

The SEC acknowledges that Scope 3 emissions may be the most difficult aspect of complying with the proposed Rule. From a technical standpoint and by definition, Scope 3 emissions cannot be directly measured and are inherently estimated. All Scope 3 calculations have some degree of uncertainty.

While better accounting for Scope 3 emissions is vital to solving the climate challenge, the technology and software for doing so is still in its infancy for many sectors and factors of production. As an accommodation, the SEC proposes to exempt “smaller” companies, allow a phased-in approach by adding a year to a company’s Scope 1 & 2 disclosure requirements, refrain from extending an attestation requirement, and establish a new safe harbor rule to reduce liability. While acknowledging the exemption, the proposed Rule will likely disproportionally affect smaller companies because of the additional burdens that many larger companies have already bore by exiting regulations. The phased-in approach is certainly some help for certain companies, but given the impact of the Rule on corporate decision making and the incredible burden this new requirement will have, a one-year extension may seem de minimis. While the lack of attestation appears to be an accommodation, when coupled with the enormous amount of disclosure and change in business behavior required by the rule, a reprieve from attestation may be the least of a company’s worries, though CFOs may disagree. It is noteworthy given SEC Commissioner Allison Herren Lee’s strong support of attestation for Scope 3. Lastly, while the safe harbor provisions will add a layer of protection, the SEC appears to go out of its way to explain when those provisions are not applicable i.e., during SEC enforcement action. This provision needs to be clarified if it is to truly be an accommodating safe harbor.

Setting aside the accommodations that the SEC puts forth to soften the blow of this requirement, the SEC needs to better explain why this difficult to obtain data, that is neither controlled nor owned by the company, should be a disclosure requirement. In mandating this information, the SEC is forcing companies to by threat or persuasion do their enforcement job for them. If disclosure for investors is the goal, then investors can evaluate the emissions of others along a company’s value chain. If, however, that data is not obtainable, then the SEC needs to explain why investors need that information to make an investment decision. And if a certain class of investor demands that information, it is incumbent upon the SEC to explain why all investors should ultimately bear the high costs associated with obtaining that data as reflective though a lower rate of return.

Conclusion

Publicly traded companies from all sectors have been addressing climate-related risks for years. Certain investors have put considerable pressure on companies to account for that risk. As climate risk is incorporated in strategic and operational decisions, some companies see an opportunity to gain market share with changing public opinion on sustainability. Each year more companies disclose their greenhouse gas emissions, weigh climate change in investment decisions, and set voluntary targets for reducing emissions. Many companies are striving for net zero. However, the proposed Rule’s new reporting requirements and disclosure mandates may change the nature of voluntary goal setting due to concerns about triggering additional disclosure requirements. While companies once voluntarily used the TCFD to assist in certain aspects of their disclosure process, now the SEC is mandating all of its recommendations and adding a few more of its own.

These additional requirements are a direct reflection of pressure that certain institutional investors and environmental activists have demanded with the goal of linking climate policy to the governance of public companies. However, as a global problem with differing impacts occurring over different geographies and timelines, and with negative and sometimes positive effect, climate policies that would be in the best interest of society are not always in the best interest of all investors. Or put another way, requiring this data may well be for reasons other than financial and arguably contrary to the longstanding belief that individuals invest in companies to maximizing returns on those investments.

Publicly traded companies should continue to analyze climate risks, market changes, and consumer demands with an eye toward disclosure. However, sought-after climate emissions and risk data, while in important for certain investment decisions, should not be assumed to be material to all companies.

For press inquiries, please contact [email protected]